Reportedly, the jewellery market in India is worth INR 7,00,400 Cr, and contributes:

🔷 7% to GDP

🔷 15.71% to total merchandise exports

That’s how big the jewellery segment is.

Here’s something interesting ➡️ in 2023, only 2.32% of all jewellery sales were attributed to online channels – that’s a major jump, considering online jewellery sales were practically non-existent in India 15 years back!

In 2008, Mithun Sacheti and Srinivasa Gopalan launched CaratLane aiming to revolutionise the way Indians shop for fine jewellery.

The mission was clear—go digital, eliminate middlemen, and offer price transparency in a traditionally opaque industry.

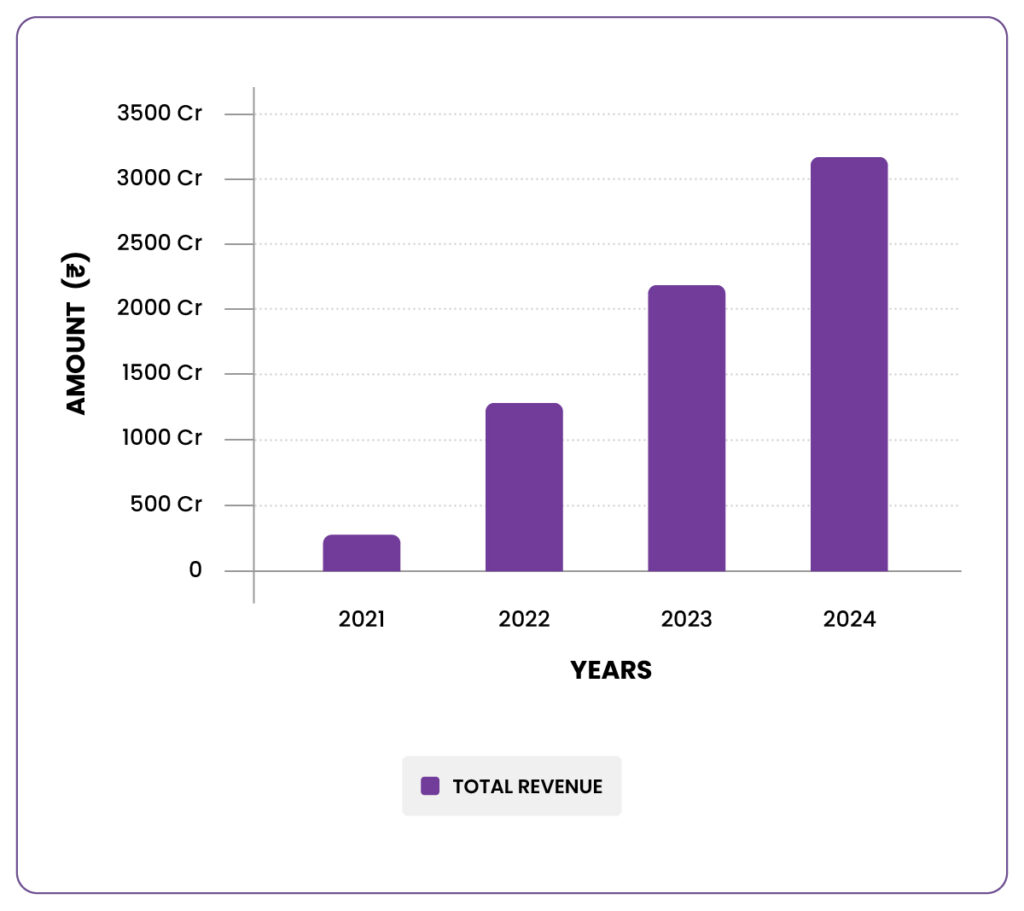

Fast forward to 2024, CaratLane is thriving. Amazing milestones, we must say!

🔷 INR 3000+ Cr revenue in FY24

🔷 Fully acquired by Titan

🔷 250+ retail stores across 80+ Indian cities

Without further ado, let’s break down the growth playbook of CaratLane!

How CaratLane Disrupted An Industry Steeped In Tradition

Mithun, with roots in the jewellery business (his family owned Jaipur Gems), had insider knowledge but wanted to modernise the industry by selling jewellery online. So, he pioneered a tech-first, consumer-centric approach!

The biggest hurdle that Mithun jumped was winning over consumer trust, which he did through:

✔️ Transparency: Every CaratLane piece is BIS-hallmarked and GIA-certified for diamonds, ensuring quality and authenticity

✔️ Virtual Try-On: An AR-powered feature allows customers to virtually try ear-rings and some other jewellery before purchase, boosting engagement rates by 50%

✔️ Try at Home: Customers could try up to five pieces at home for free, leading to an impressive 25% conversion rate

And just like that, by 2016, CaratLane was already a well-established name, growing at a rapid clip.

Then came a defining moment when Titan stepped into the picture. An acquisition!

The “Why” Behind Titan’s Acquisition Of CaratLane 💎

Titan Company, a part of the Tata Group, acquired a controlling stake in CaratLane for around INR 357 Cr, valuing the company at INR 720 Cr.

While CaratLane was on a rapid growth trajectory, this acquisition further accelerated its growth journey, creating the perfect synergy between Titan’s offline dominance and CaratLane’s digital prowess.

Titan’s Perspective: The Strategic Fit

Titan, with its Tanishq brand, was already a market leader in India’s organised jewellery sector. But the world was rapidly shifting online, and Titan wanted a bigger piece of the digital pie. CaratLane presented a perfect strategic acquisition for multiple reasons:

A Tech-First DNA

Unlike traditional jewellery brands, CaratLane was built on a tech-first model. This gave Titan access to not just an online platform but a robust digital infrastructure that could be integrated into their existing operations.

Targeting Younger Demographic

By 2016, CaratLane had successfully captured the attention of millennial customers, who are more inclined toward purchasing jewellery for daily wear, which was crucial for Titan’s long-term growth.

Omni-Channel Synergies

Titan had a strong offline presence, while CaratLane excelled online. The acquisition allowed Titan to merge these two channels and create an omni-channel strategy, enhancing both companies’ reach.

CaratLane’s Perspective: They Said Yes!

A Resource Pole-Vault

Titan had decades of experience in offline retail and helped CaratLane expand its physical presence. Today, 45% of CaratLane’s revenue comes from its 250+ retail stores.

Additionally, Titan’s manufacturing capabilities, supply chain, and brand equity enable CaratLane to grow at a much faster rate!

The Trust Factor

Despite their efforts, CaratLane still faced a degree of consumer hesitancy when it came to making high-value purchases online. Partnering with Titan, a trusted household name, instantly provided the trust validation CaratLane needed.

In a candid interview, Mithun shared, “While we were growing fast, being a part of the Tata Group helped us unlock growth faster. We could leverage their offline retail expertise and credibility to penetrate even deeper into the market.”

The Post-Acquisition Growth Story

The Titan-CaratLane partnership proved to be a match made in heaven.

✔️ Revenue Push: From a mere INR 60 Cr in FY16, CaratLane’s revenue skyrocketed to over INR 3000 Cr in FY24, with 30% YoY growth.

✔️ Titan’s Digital Play: With CaratLane’s expertise, Titan accelerated its own digital transformation. Today, 20% of Tanishq’s sales are driven by online channels, a number that was negligible in the pre-CaratLane acquisition phase.

✔️ Tier 2 & 3 Expansion: CaratLane aggressively expanded into Tier 2 and 3 cities, areas where Tata’s trust factor is instrumental in consumer purchasing decisions.

As CaratLane continues to ride the omni-channel wave, it’s clear they have mastered the art of staying relevant and doing the needful to gain a competitive edge.

A few more carats on CaratLane’s crown, maybe?

.svg)

.svg)