A Power Crisis Disguised As A Business Opportunity ⚡

India’s power problem is real.

🚨 250 Mn households still face long power cuts and voltage fluctuations.

Even in cities, homeowners are crippled by sky-high electricity bills.

Solar should’ve been the fix, but it wasn’t.

Here’s why👇

❌ Too expensive—₹1-2 lakh upfront

❌ Too complex—No clear info, no trusted sellers

❌ Too niche—Most solar brands focused on big industrial projects only

But in 2018, brothers Amol & Amod Anand saw the gap.

The Insight?

👉 Homeowners needed affordable, easy-to-install solar solutions

👉 Tier 2 & 3 cities were a ₹5,000 Cr untapped goldmine when it came to solar panels

Loom Solar was born!

The idea was to make solar energy mainstream. Cut the jargon. Lower the cost. Make it accessible.

Loom Solar didn’t just sell panels. They owned the entire journey—education, financing, installation, and maintenance.

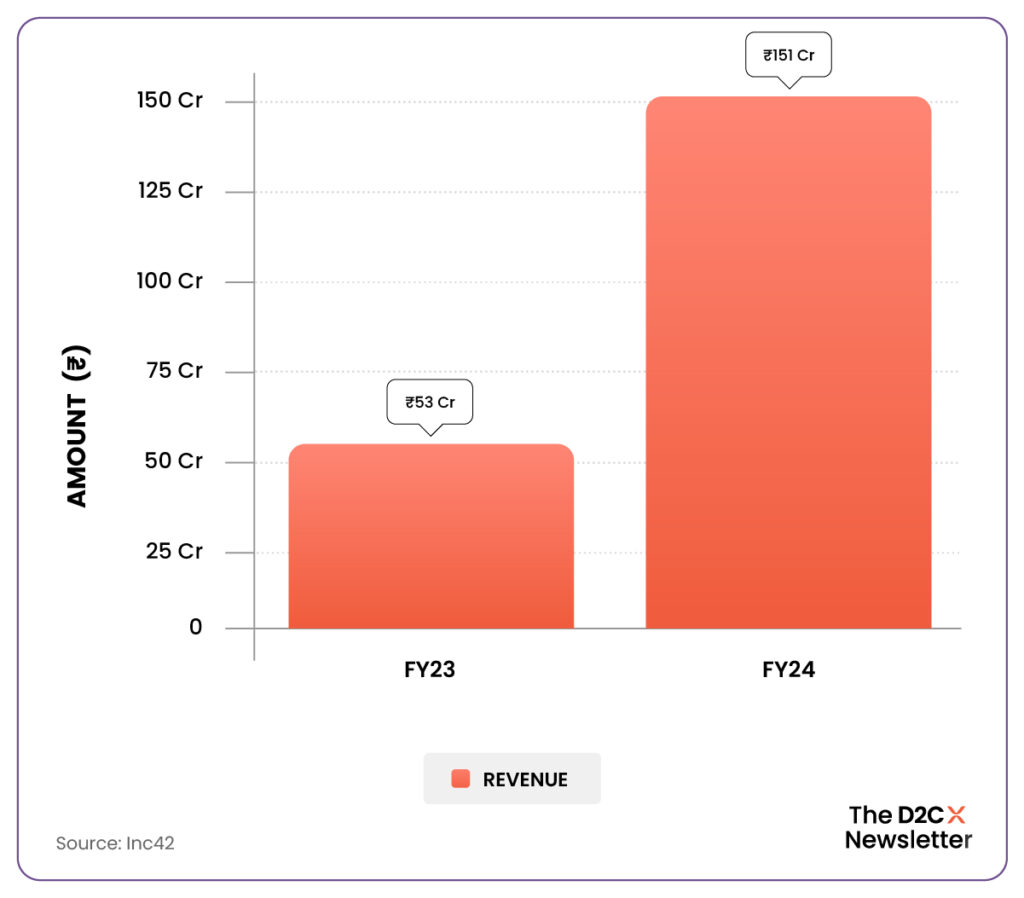

From ₹53 Cr in FY23 to ₹151.5 Cr in FY24, they ~3X’d revenue in 12 months.

No crazy VC burn. No shortcuts.

And yet, they’re outpacing legacy giants like Tata Power Solar, Havells, and Luminous.

How? Let’s break it down ⬇️

A Digital-First Playbook Built On E-Commerce & YouTube

Most solar brands rely on offline dealers and government contracts. Loom Solar didn’t.

Instead, they went all-in on digital.

✅ Amazon & Shopify-first approach—selling directly to homeowners nationwide

✅ 1.73L YouTube subscribers & 100M+ video views—educating consumers on solar benefits

✅ Hyper-targeted Google & Facebook ads—driving awareness and lead generation

Within 30 days of launching, they onboarded 100 customers. Today, 70% of Loom Solar’s sales come from digital platforms.

Their SEO + influencer-driven strategy means they don’t rely on traditional distributors, keeping margins high and marketing costs low.

Cracking The ₹1 Lakh Barrier

The biggest barrier to rooftop solar? Cost.

Loom Solar tackled this with smart financing solutions:

🔹 Launched EMI options—20-30% down payment, flexible monthly plans

🔹 Partnered with banks & NBFCs—making financing as easy as buying a fridge

🔹 Created the ‘Engineer Visit’ Program—homeowners pay for a pre-installation site survey

This led to more first-time solar buyers with lower upfront investment and higher conversion rates. Once customers saw an ROI, they upgraded systems

The ‘Shark Bifacial’ Panel Changed The Game

While competitors sold generic solar panels, Loom Solar invested in innovation.

🚀 Shark Bifacial Panels—India’s first high-efficiency, dual-sided solar panel.

✅ Generates power from both sides—15% more energy output than standard panels

✅ Works in cloudy weather & low sunlight—perfect for Indian conditions

✅ 40% less rooftop space required—more power, smaller footprint

Quickly, these panels became the best-selling solar panel in India, now driving 60% of Loom Solar’s revenue.

Beyond Solar Panels: The Full-Stack Energy Play Of Loom Solar

Loom Solar expanded to a complete energy ecosystem.

🪫 Lithium-ion batteries—enabling power storage for homes with unreliable power supply

🔌 Smart solar inverters—optimising energy usage & backup power

🌍 IoT-enabled solutions—real-time monitoring & efficiency tracking

Now, Amol and Amod are planning to increase battery & inverter sales to 50% of revenue by 2025 and expand the reseller network to 10,000+ dealers nationwide.

🌍 Can Loom Solar Hit ₹500 Cr By 2026?

Instead of competing with Tata Power in large projects, Loom Solar focused on residential solar—a ₹5,000 Cr market.

🔹 Partnered with 3,500+ local retailers—for offline sales in Tier 2 & 3 cities

🔹 Created a fast-track installation service—3-day delivery, 48-hour setup

💡 The goal?

Grow from 1% to 5% residential solar market share by 2025.

Now, at ₹151 Cr, Loom Solar is at an inflection point. But can they 3X again to ₹500 Cr?

Given their digital-first strategy, smart financing model, and relentless innovation, Loom Solar is on track to hit ₹500 Cr sooner than expected.

What do you think?

.svg)

.svg)